Summary

- There are over 60 different cases of drug shortages in the US, and most are generic sterile injectables.

- Generic sterile injectables is a $20 billion industry projected to grow by $10 billion by 2018.

- Low profit margin, strict regulation, and costly investments are turning companies away from the industry, leaving profitable opportunities for firms that remain.

Of the 65 drug shortages listed by the Food and Drug Administration, more than 40 are of the generic sterile injectable variety. Nitroglycerin, used intravenously to treat hypertension and assorted heart conditions, is one of those drugs. Last year, two manufacturers -- Hospira (HSP) and American Regent, owned by Luitpold Pharmaceuticals -- stopped selling injectable nitroglycerin, making Baxter International Inc. (BAX) the nation's sole supplier. Now The New York Times reports that Baxter, who has rationed the in-demand drug since January, is drastically reducing its shipments to hospitals.

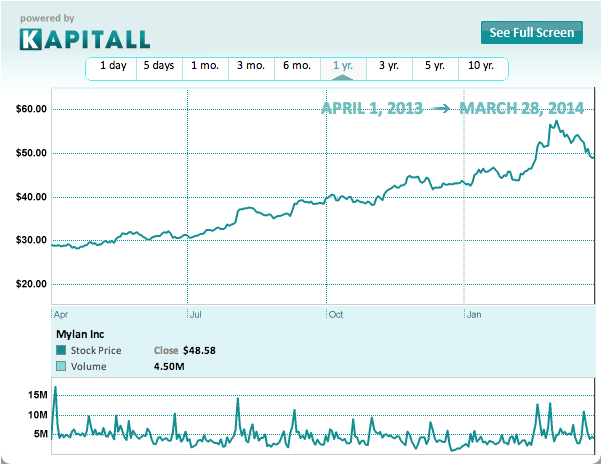

eneric injectables -- drugs delivered to the body via needle and syringe or IV -- is a $20 billion industry in the US. According to McKinsey, that figure is expected to rise to $30 billion by 2018 due to patent expirations on brand-name drugs, growing demand in emerging markets, and better products. That growth potential motivated Mylan Inc. (MYL) to acquire Agila Specialties Private Limited, a generic injectables manufacturer, for $1.3 billion in February 2013. Yet, despite the billions to be made by selling the drugs, many manufacturers have suspended production.

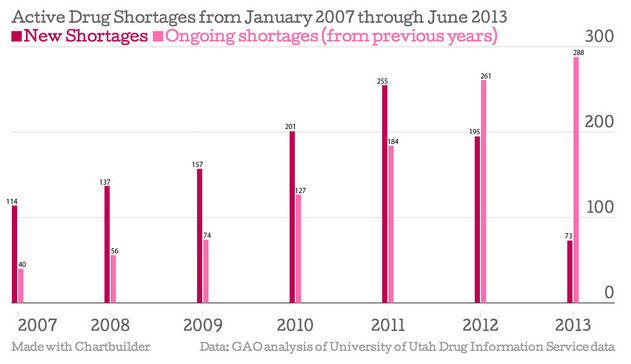

A February report from the Government Accountability Office (GAO) cites quality concerns and limited manufacturing capacity as the main causes of generic injectable drug shortages. Increased regulation has made it harder for companies to make drugs and maintain facilities that are up to standard, resulting in widespread manufacturing delays.

Drugmakers must invest large amounts of money to improve facilities and operations, and the GAO report states that low profit margins dissuade companies from taking the plunge. The high cost of plant improvement led German firm Boehringer Ingelheim to close it Ohio-based Ben Venue lab, which made sterile injectables, at the end of last year. Boehringer had already spent $350 million on the facility, and additional improvements would lead to $700 million in losses over the next five years.

Investing in Infrastructure

Regulatory setbacks and the high price of investments will reduce the number of manufacturers involved with generic sterile injectables. This represents an opportunity for drugmakers that remain in the market after overcoming manufacturing challenges in the near future.

Take Hospira. The company manufactures numerous generic injectables, including in-demand IV solutions; vecuronium bromide, a muscle relaxant used in surgery, intubation, and executions; and lorazepam, an anti-anxiety sedative given to patients prior to surgery or to treat seizure disorders. It's one of three drugmakers, along with Baxter and B. Braun Medical, currently working with the FDA to address the problem of critically low stores of standard IV solutions.

In Hospira's Q4 2013 earnings call, CEO F. Michael Ball noted that competitors' supply constraints helped drive up net sales of generic injectables in the Americas by 7% at constant currency (6.1% at actual currency) to $572.6 million from a year earlier. Overall, the company's generic injectables segment -- Specialty Injectable Pharmaceuticals (SIP) -- grew by 6.4% at constant currency (5.2% at actual currency ) to $732.7 million in the quarter. Meanwhile, the company's underperforming Medication Management segment drove down revenue by 1.3% to $1 billion.

The company's operating cash flow dropped to $317 million in 2013 from $478 million a year ago. Capital expenditures -- facility upgrades and IT projects -- rose from $290 million to $354 million, leaving Hospira with a negative free cash flow of $37 million. The improvements at Hospira's Austin and Rocky Mount plants led the FDA to upgrade both sites to voluntary action indication (VAI) status, bringing them closer to resuming full production. However, the company is still dealing with FDA warnings at facilities in Colorado, Illinois, Kansas, Costa Rica, and India.

Hospira is set to increase its supply of generic injectables this year thanks to a new facility and an acquisition. Ball told call participants that Vizag, Hospira's new injectables plant in India, is on track to begin commercial production at the end of the year. He also commented on the company's agreement to acquire Brazilian oncology distributor, EVOLABIS, stating, "This development marks progress on our emerging market strategy in which Brazil is a major component." The acquisition will add 15 products to Hospira's Brazil portfolio, making Hospira an attractive buy for value investors.

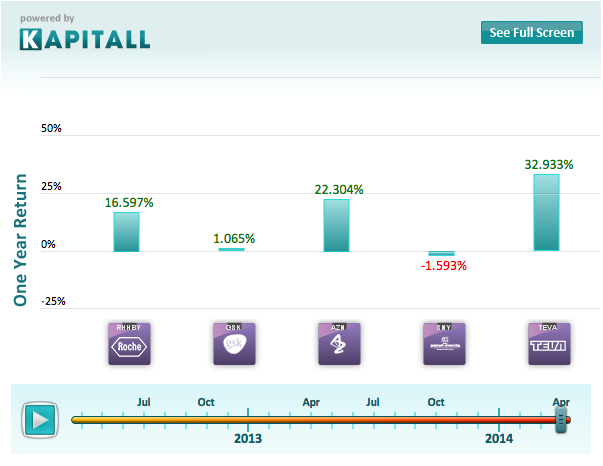

Reuters reports that major drug makers like GlaxoSmithKline (GSK), Roche (RHHBY), AstraZeneca (AZN), Sanofi (SNY) and Teva (TEVA) are developing new injectables to cut into Baxter's newfound market dominance. With billions of dollars of revenue on the table, there is a lot of potential profit to be made by the first company to exploit this gap in the market.

Conclusion

Baxter is well positioned to profit from the perfect storm that has created a market opportunity for injectables. In the long term, the entire field is poised for growth as new drugs and come online.

No comments:

Post a Comment